Saturday, March 31, 2007

Today's Conundrum... contd.

Today's Conundrum

I think I'm going to sit this one out. The Yen is under pressure, and oil should lose some steam now that the Iran/UK sailor thing is in the UN. In a way, if the Iranians had nabbed American marines, we would be preparing for WW3 now. Its probably some overzealous Iranian Navy captain who started this - and now Iran has to back its own soldiers rather than give any ground even if they are in the wrong. In my mind: UN = not WW3 (yet) - so I still think Gold can go down to $655 (Spot) and $660 (Forward), assuming that the USD remains strong for a bit.

On to my position in TLS.

I entered the position thinking a double-top had formed, judging on the action in the morning. I was proved wrong in the afternoon. So I see no point in continuing with this position and should exit.

I entered the position thinking a double-top had formed, judging on the action in the morning. I was proved wrong in the afternoon. So I see no point in continuing with this position and should exit.If I didn't have this position, I'd take the chart to be bullish (MACD uptrend, rising volume, has broken a resistance level), and would be thinking of buying today. So do I flip my position?

Thursday, March 29, 2007

The Market is Cruel

Today, I shorted TLS @ $4.49, since it looked to have formed a double top at $4.55 , and guess what - it punches through and closes @ $4.62! So I'm trading in the red in this one - when I had fantastic visions of making some decent $$. Apparently, the reason for this was because of telecom re-rating happening in the US due to higher oil prices (communication being a substitute for transport). Also, read a rumour on HC that in May, when the Future Fund can get out of its T3 holding, TLS may come into play.

Now the thing is - what do I do with this position? I have a SL @$4.79, just above the next resistance point @ $4.74 - do I switch my position about?

I have a few speccy shares on my investment wishlist - TFE and TRF among them. Unfortunately, I haven't had any money lying around to do anything about them - and have looked helplessly on as TFE has gone from $0.47 to $0.61 earlier this week and TRF ran from $0.81 y'day to $1.02 today.

OK - so you say - "dude, you could have borrowed the money"; and I say "I could have - but I have an aversion to debt, and taking it on to buy speccy stocks isn't my idea of smart".

On the positive side, ARU and NUP have been blazing along; and APG had a good run today as well. So, maybe, the market isn't cruel after all - it is just ... the market.

Charts

| Charts may require regular use of Refresh button to ensure old data is not being stored in cache. Australasia/Asia (AXJO, Hang Seng) Europe (FTSE, DAX, CAC) US Markets (DOW, Nasdaq) Kitco 24hr Gold, Kitco 24hr Platinum, $AU v $US

1 Year Exchange Rates AU$ v US$ and AU$ v Euro Silver

International Metal Prices (London) Click HERE for nearly Live Metal Prices and Graphs. Base Metal Stocks LME.

NYMEX Warehouse Stocks

24hr Base Metals Charts in $US Dollars per pound

6 Month Uranium Chart

Click HERE for NYMEX Live Energy Prices and Charts inc Brent Crude, Henry Hub etc. |

Wednesday, March 28, 2007

The Iran effect on the USD

Are we out of the woods?

Is this rally sustainable? Yesterday's data on new home sales for February in the US (down 3.9% to a 7 year low), on top of the sub-prime problem, indicates that the crisis in the housing market may not be close to the bottom yet. Indeed, Roubini takes this figure as further evidence that supports his call of a hard-landing and recession. Dan, however, thinks otherwise.

Contrast this with the stats in Australia, where home sales have jumped. With the A$ rising to 10 year highs, due to expected higher interest rates, that's another huge vote of confidence in the underlying China/minerals export story. However, we also have the collapse of Fincorp - which has gone largely unreported by the media.

I think the Aussie stock market is due to decouple from movements in the US markets... but what do I know?

My first trade...

In hindsight, I suppose it was greed that made me buy when the market had risen ridiculously quickly on the chart. I think the lesson here is only buy at a price that I've spent time reflecting on - and not get carried away by the drama in front of me. A bit more reflection, and a bit less 'seat of the pants' is called for.

Tuesday, March 27, 2007

Finally!

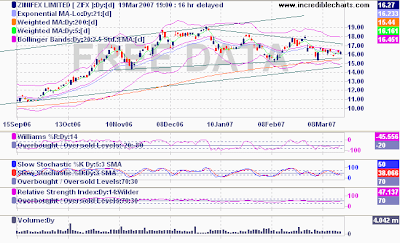

Long OXR @ $2.7 (current price $2.8), and short ZFX @ $17.15 (current price $16.2). These haven't been filled yet, but I expect it won't be long.

Tried the long position on LHG, however "Computer says no".

When I think about it, both these positions are me trying to 'catch a falling knife'. Which, I've been told is a bad idea. Conceptually, I get that - however, since I'm not sitting in front of the screen all day (much as I would like to), I need to make (what I consider) to be calculated risks. Let's see how this plays out....

Methinx there a bearish pattern developing in AMP. Will watch it some more.

Monday, March 26, 2007

Range Resources

Sunday, March 25, 2007

World Cup Crock

First off, Bob Woolmer - just as I thought, the police suspect his death was murder; and the underworld betting syndicate is a prime suspect. This is a tragedy of monumental proportions - its like the 9/11 for Cricket, and is going to impact the way Cricket in managed and played from now on.

Last nite, Sri Lanka defeated India, who have been all but bundled out of the tournament. From finalists in 2003 to a first round exit in 2007. One would have expected this from Bermuda, or the 'minnows' in the world cricket - not a self-accoladed super-heavy weight.

The point here is: the BCCI is the richest Cricket board in the world; and the Pakistan Cricket Board is no slouch either in the money stakes. Unfortunately, the power and money has attracted politicians and the power-hungry to run the show. As a result, the state of the game loses focus - the objective seems to be to travel around the world and bully the ICC - and the teams become minnows of the game.

Australia, NZ and South Africa win matches consistently, yet their boards have nowhere near as much money as the BCCI or the PCB control. What they do have, however, is people who understand the game, and what it takes to win. The sub-continent needs to focus on treating the game as a professional sport - which requires discipline, strategy and commitment. I'm not implying that the players don't have that - but they can't do it alone. The controlling bodies need to pull up their game. There's no reason why our cricketers can't have access to the best technology and cutting edge practices that Australia uses - despite being awash with funds, we always seem to be at least a decade behind the world leaders. Australia, and now NZ, keep elevating their preparation to another level - the sub-continent seems to be still struggling with concepts introduced in the 1990s.

India already has one fiasco in the Indian Hockey Federation - after winning 24 consecutive Olympic gold medals, Hockey and India are going nowhere together. Unless there is good leadership, the BCCI will become another IHF, and India's position in Cricket will be no better than our position in Hockey.

Thursday, March 22, 2007

This stinks!

So I call IG Markets, and am told that "My Shares" will be activated in 10 minutes. Sure enough, that happens. The next thing I know, I get an email from IGM saying that unless I make 4 trades a month, I'll have to pay $38 for access to ASX prices. Not only is that wierd, coming AFTER I've signed up, its also stoopid since everyone else (and I mean Tricom) gives me free data - even on a demo account! That's Stink#2.

I think - OK, we'll try to work with that - let's get our orders in. Which leads me to Stink #3 - and this one smells. I could not place a single order!! LHG trading @ $3.16, I try to place a Buy @$3.01 with a SL @ $2.95 - I could almost hear Carol Beer saying "Computer says No". ZFX trading @ $16.33, I try to place a Sell @ $17.15 and, again, I get "Computer says No".

Fed up, I went about my day - and for the last 2 hours have been comparing Marketech's platform with Tricom's. I now think Tricom's is vastly superior to both IGMs and Marketech's in terms of breadth of low margin products (such as the NY Gold/Silver mini) offered; but most importantly at least I can put an order through, even if its outside market hours! Methinx a switch to Tricom is on the cards. Now, does IGM have a "cancellation fee" policy? That would really piss me off.

Wednesday, March 21, 2007

CFD Positions ver 1.0

There are only 2 trades that I'm fairly confident of at the moment:

Long LHG @ $3.01 (stop loss @ $2.95) with a target of $3.40

I view LHG as a proxy for Gold - and since I'm generally bullish on Gold this year (who isn't?) I need to be long LHG more times than not. The $3.01 price is just above the trend-line from May 2005, so I'm pretty confident it will hold. Weak USD = strong Gold price. I might change the price target of $3.40 - since its gone up to $3.60 recently, but we'll get to that if we get into play.

I view LHG as a proxy for Gold - and since I'm generally bullish on Gold this year (who isn't?) I need to be long LHG more times than not. The $3.01 price is just above the trend-line from May 2005, so I'm pretty confident it will hold. Weak USD = strong Gold price. I might change the price target of $3.40 - since its gone up to $3.60 recently, but we'll get to that if we get into play.Short ZFX @17.15 (stop loss @ $17.25) with a target of $14.65

While ZFX is a great company, with good cash-flow, great management and low P/E, Zinc prices are on a highway to hell, with stocks rising for the first time in (I think) 5 years. Again, it looks like a strong A$ is on the way - which only hurts the earnings outlook for ZFX.

While ZFX is a great company, with good cash-flow, great management and low P/E, Zinc prices are on a highway to hell, with stocks rising for the first time in (I think) 5 years. Again, it looks like a strong A$ is on the way - which only hurts the earnings outlook for ZFX.

The Problem with Banks

In 2003, when I came to Australia, my first encounter with a bank here was with CBA in Burwood. I realised that personal banking needn't be a chore. No queues... ever! Fast and efficient staff... fantastic! As a result, it took me awhile to get onto Internet banking (vastly ironic, since I was studying Information Systems!) - I enjoyed immersing myself in the joys of receiving customer service.

That changed when I finished studying, and the 'student' tag was removed from my account. I had to now actually PAY the bank $6 a month (now its $4) to hold my money! Absolutely insane, I thought! For all of India's banks woes, at least they never charged you to hold your money. In fact, every personal transaction account also acts as a Savings account, and pays a decent interest rate.

Since then, banks have returned to become a pet peeve. I refuse to understand why I should be charged fees to have access to my money. What about the old "3-6-3" (borrow at 3%, lend at 6% (thus earning the 3% spread), be on the golf course by 3 pm) mantra? Shouldn't that cover all expenses, including golf clubs? And isn't ensuring access to ATMs, internet and telephone banking covered under the 21st century definition of "customer service"? Shouldn't the banks be spilling their guts to get my business? Since they aren't, am I supposed to feel 'privileged' that someone has condescended to hold my account?

In addition, I was subjected to a large dose of peanuttage from CBA last month. I was charged 3 x $30 for overdrawing on my limit (cashflow issues that always got sorted out 1 day too late on each occassion) + $25 at the end of the month for a weird fee + $2.something as interest. The strange thing is:

1. the money from the direct debits went to Commsec (i.e. CBA) and Save The Children (a charity I support)

2. I called CBA and was told that after the $90 in fees that went out over the period of a week, I wouldn't get slugged with any further charges or interest... and that's exactly what happened at the end of the month. When I called CBA back, I was told to go look at something in the PDS that apparently covered their a*se.

I've realised after a lot of thought and reading, that banking in Australia is oligopolistic as a result of a unique "Four Pillars" policy which prevents the top 4 banks from merging with one another. As a result, the big banks are inefficient behemoths - if the policy was scrapped, the fear is that as a result of the ensuing mergers jobs would be lost, which is always bad news for politicians. Because of this policy, bankers have their customers over a barrel; and given that Australia is only a 20 million person market spread over a massive continent, none of the big international banks are likely to have a serious crack at it. In this environment, banks collude with each other to screw the individual. You know its true when they stick their name on most of the tall buildings in your city - just to rub it in that they own you.

The situation is unlikely to change in the near future; and the only thing for me to do is to move my banking to where I see the best value (i.e. lowest transaction costs and minimum peanuttage).

Here is the result of a 30 minute study I did just now (criteria: no minimum balance, unlimited Net and ATM trasactions) on various transaction accounts in the market:

BANK -ACCOUNT NAME - LOWEST MAINTENANCE CHARGE (p.m.)

- NAB - Smart Direct - $3

- CBA - Streamline - $4

- WestPac - Westpac One - $5

- ANZ - ANZ Access Select - $2

- St George - Simply Freedom - $6

- SunCorp - Everyday Banking - $5

- Bank of Queensland - Reverse Charges - $4

- BankWest - Lite Transaction - $2.99

- Bendigo Bank - Ultimate Everyday - $2

- Citibank - Citibank Plus - $5

- AMP Banking - Transact - $8

Trading Thoughts for 2007

GLOBAL

- USD to remain weak

- Low global inflation

- Money is cheap

- Slowdown in US, but pick-up in EU + developing economies

- Oil prices to remain historically high

- Re-alignment of global economic forces in progress - gold to be a dominant standard again

- More international takeovers - especially in Africa of minerals

- Strong economy

- Higher interest rates

- Moderate inflation - under control

- More emphasis on infrastructure

- Australia to sign N-agreement with India

- Forward/Futures market in Uranium to come into existence

- Australia to sign Kyoto Protocol - or increase funding for green technology

- More takeovers in Australia - good year for investment bankers

- Bad year for banks and insurance - drought, bushfires, economic slowdown

- Fall in AUD - to reflect fall in resources prices, good year for grain exports, bad year for mining cos. (except Gold)

Global:

- Re-emergence of growth in the Japanese economy + easing back (i.e. not a complete 'unwind') of the Yen carry-trade due to a stronger Yen + possible interest rate rises.

- Money is still cheap - plenty of petro-dollars about, plus HUGE amounts of the USD lying about in China and Japan.

- Strong dollar: due to weakness in USD but combined with demand for resources from strong China - earlier I had believed that the Chinese economy would slow down in tandem with the US economy - I now believe that the growth in the Chinese domestic economy is an even bigger animal about to be unleashed on the world.

- Weaker profits for Aussie based miners (due to strong A$), except where offset by rising international prices of the underlying commodity (eg. Uranium, rare earths, molybdenum (?))

- Good year for banks, insurance and mutual funds - more capital inflows into the Aussie market

- At least 1 more interest rate hike this year

- Property market - to remain at insane levels. The higher it goes, the harder it will fall.

CFDs, etc.

The flip side is that the IGM platform is static, and can't be tailored to suit my needs. Also, Tricom has a daily newsletter from Marcus Padley, who I think is a severely under-rated dude. Since I'd signed up for a demo-version of the Tricom platform in late Jan, I'm still on the mailing list - and so am pretty happy...

Funding the account, however, has proved to be quite an event. As usual, since I don't have any money, I've had to ask my long-suffering Woman for a loan. On Sunday, 11 March, she deposited $5K into the IGM nominated account. Monday was a bank holiday, so things finally got going on Tuesday. By Thursday, however, the funds had still not showed up in my account. A phone call revealed that they couldn't trace the money! Several rounds of phonecalls later, it became clear that the seed money needed to come through MY bank account (apparently, there's this whole thing about money-laundering that they want to avoid). So the money was sent back to My Woman, who sent it to me, and I finally got round to funding my account today.

Now, as we wait patiently for it to get activated for trading, I came across this article. This quote is particularly disconcerting: "You are on the learning curve and are paying your dues. How long does it take? This is the question most frequently asked. The answer is: in my experience, it takes 10 years and 10-20,000 hours of practice before the average person gains enough expertise to succeed consistently in the trading shark tank." 20,000 hours of practice!! Crap - I'm screwed!!!

Tuesday, March 20, 2007

Monday, March 19, 2007

World Cup Cricket

However, to put things in perspective, Bob Woolmer passed in what may eventually be labeled as 'mysterious circumstances'. My money is on the D-company doing the dirty on him in that eventuality.

Sunday, March 18, 2007

Early Days

However, last November, we (i.e. My Woman and I) subscribed for a modest 500 shares in the T3 float. Since that went well, emboldened, I started looking at this animal called the stock market with interest.

The main reason why I had never invested in shares before was because I didn't understand them. My understanding of the Indian share market was that 'fundamentals' mattered little - sentiment was all-important; so much so that if the Dow Jones fell marginally, the BSE Index would gyrate like a Bollywood heroine's bosom during a particularly melodramatic scene, and with all the attendant tears. Plus, numerous securities scams in the 90s didn't help me feel interested in finding out more either.

When I arrived in Oz in 2003, I briefly considered if the ASX was going to be different. I went online, decided that since BHP was the only company I'd heard of, it might be worth putting up a few $$. However, since I didn't know whether that was a good time to buy or not, and not knowing where to begin, I quickly found other pursuits to follow. As I recall, BHP was trading around $10. After T3, I went looking for BHP again - found that it had gone as high as $32 the previous May, and felt duly foolish.

Then, I was intrigued, and in January 07, I opened a ComSec account and bought AWB. Why? Because it had gone from $2.50 to $3.26 in just over a month, and I saw somewhere that it had come down from $6+ levels from June of '06 due to the Iraq Wheat scandal. I thought - heck, it might just go back to $6 again, now that the Cole inquiry had submitted its report and heads had rolled.

Since then, I've invested over $8000 in the market ($5000 from My Woman, and $3000 from me); read the mandatory book about Warren Buffett and about finding value in the markets, and found Hotcopper and IncredibleCharts. As of today (i.e. post-'China Syndrome') we are up 10% on our investments. I shortly intend to start trading CFDs, and keeping track of those trades is the main purpose behind this blog. Yup - public hoomiliashun - nothing like it!

Why?

So, you ask, "What's possessed you to try this? If you want a deposit, why not just go to a casino; or buy a Tatts Lotto ticket? Or get a better paying job?" I mean, fer-cryin-out-loud - there's so much beer that going undrunk while you make a giddy fool of yourself in public!

(Yes - you, the one looking at these points right here ----> : ..... you did ask that)

And in response, I sit you down, pass you a tissue, and embark on a tale of woe and sordid betrayal.

It all began many years ago - even before I was born ... even before you were born... in fact, even before Time. And then Time invented itself, the dinosaurs came and went, the Kama Sutra was written, Beer was discovered and through a confluence of last two world-changing events, we came to be.

Next thing I know, I find myself at university. Nothing had prepared me for this. Nothing, I tell you, nothing at all! I felt like Sirius Brontosaurus (nice guy - though he never quite recovered from that experience with the meteor), in his last days - lumbering through a wasteland searching for true meaning among the chaos, or at least another dinosaur from the fairer sex.

University is strange - you don’t know why you're there, you get fed a bunch of stuff you can't use, and you accumulate a lot of expensive junk along the way.

Like books; and I never much used them either - preferring to rely on my 'Superior commonsense' (hey, I passed, right - so roll those eyes elsewhere)

And the stuff you really need - like hot dates, or el-cheapo scalped tickets - you cant seem to get enough of 'em either.

Anyhoo, one thing led to another. Someone hired me, I worked for awhile. Then I quit, and someone else hired me. Then, I quit again and came to

And, as you would, I met someone and stayed on. Of course, now we need a place to nest, and that’s the kicker, see - house prices are insane. And I mean nuts! Our combined income is about $80K. The median price for a house is about $360K. Our combined savings (net of debt) as of Jan. 1, '07 was $20K. Our average age is 31.

See the problem?

Now I’m fairly confident the situation is not going to change. House prices aren't going to halve, and our incomes aren't going to double anytime soon. Taking on a humongous debt that we can barely repay is not only stupid, foolish and suicidal, it's also out of the question.

But - and this is the moment of inspiration folks, savour it - drastic times call for drastic measures. Hence... this.